Acquisition project | Acko Insurance

"Ever wished insurance could be simple, transparent, and tailored just for you? No middleman, no delays, yes we made it possible by making insurance D2C. Acko Insurance revolutionizes the way you protect what matters with fully digital, hassle-free insurance solutions. Serving over 78 million customers, we offer personalized car, bike, and health insurance plans at unbeatable prices. Unlike traditional insurers, Acko’s seamless online platform and zero-paperwork process make claims fast and stress-free

Join the insurance revolution and secure your peace of mind today at acko.com!"

Dissection:

- Hook: Addresses the universal frustration with complex insurance.

- Value: Emphasizes Acko’s direct-to-customer, digital, hassle free, low-cost insurance solutions.

- Evidence: Cites 78 million customers to build credibility.

- Differentiator: Emphasizes the fully digital, paperless process compared to traditional insurers.

- Call to Action: Directs to acko.com for next steps.

ICPs for my target audience

I have given the names to my 3 ICPs ie, Newly United Adventurers (ICP - 1), Young Urban Professionals (ICP - 2), Gig Economy Workers (ICP - 3), and their priority is in the flow of the order, respectively. As ACKO is in Mature Scale, I will target all 3 ICP but prioritize them as described, which will lead to focused, impactful, yet making sure that I don't neglect the low-hanging fruits and potential market share.

ICP Name | Newly United Adventurers (ICP - 1) | Young Urban Professionals (ICP - 2) | Gig Economy Workers (ICP - 3) |

|---|---|---|---|

Priority | Primary | Secondary | Tertiary |

Demographics | - Age: 25-35, recently married (1-3 years) - Income: INR 8-20 lakhs/year - Location: Urban/semi-urban, tech-savvy, active on mobile/social media - Family: No children or planning one | - Age: 25-35, single, dating, or young children (0-5 years) - Income: INR 10-25 lakhs/year - Location: Urban (Tier-1/Tier-2), highly tech-savvy, active on apps/e-commerce - Family: Single or small families, career-focused | - Age: 25-40, freelancers, delivery riders, cab drivers, small entrepreneurs - Income: INR 3-12 lakhs/year - Location: Urban/semi-urban, moderately tech-savvy, app-reliant for work - Family: Single or small families, often supporting dependents |

Pain Points | - Overwhelmed by complex insurance processes and hidden fees - Budget-conscious due to wedding expenses, new home, or assets - Distrust traditional insurers due to pushy agents, slow claims - Need simple, affordable insurance for new assets/health | - Find traditional insurance outdated, time-consuming, expensive - Frustrated by agents pushing irrelevant/overpriced plans - Need affordable bike/car/health coverage but lack research time - Want flexible, no-commitment plans for fast-paced lives | - Struggle to afford insurance due to irregular income - Need vehicle insurance for work but find premiums high, processes complex - Lack tailored health insurance for high-risk, mobile lifestyle - Avoid agents due to mistrust, inability to negotiate |

Goals | - Seek transparent, low-cost insurance tailored to budget/lifestyle - Want digital-first solutions for quick purchases/claims - Desire flexibility to adjust plans as family/assets grow | - Seek convenient, digital insurance manageable on the go - Prioritize cost-effective plans with clear terms, no hidden fees - Value speed and simplicity in purchasing/claiming | - Want low-cost, flexible insurance for vehicles/health to protect livelihood - Seek easy-to-use digital solutions without in-person visits - Need reliable claims to minimize work downtime |

How Acko Addresses Needs (Good to have thing - as the company is in mature scale, would help in better context by understaing how currently it's resolving the pain points.) | - Direct-to-customer model eliminates brokers, offering affordable, customizable car/bike/health plans - Digital, zero-paperwork platform simplifies onboarding/claims - Transparent pricing, 24/7 support build trust - Personalized options (e.g., joint health plans, car insurance) suit life stage | - No-broker model reduces costs, offers budget-friendly plans - Mobile-first, paperless platform enables quick policy/claims management - Transparent pricing, customizable plans (e.g., short-term health, bike insurance) fit dynamic needs - Seamless digital experience aligns with app-based preferences | - Direct-to-customer platform offers ultra-affordable bike/car/health plans - Digital process allows mobile app-based purchases/claims, fitting on-the-go lifestyle - Fast claim settlements minimize income disruption - Micro-insurance or pay-as-you-go options (if available) suit irregular income |

I have used the name of ICPs throughout the project*

Calls with Users

I had calls with 2 Newlyweds, 2 young urban professionals & 1 near retirement phase prospect just to understand generic behaviour & priority.

Name | Bhakti (ICP 1) | Lalit (ICP 1) | Harsh (ICP 2) | Karan (ICP 2) | Rajeev (Low Priority) |

1. Top social media platform you use? (e.g., Instagram, LinkedIn) (Social Media Usage) | Twitter (X) | ||||

2. Recently married? (Yes/No) (Life Stage) | Yes | Yes | No | No | No |

3. Moved in past year? (Yes/No) (Recent Moves) | Moved to UK two and half years back | No | Yes, Moved to Gurugram 8 months back | Yes, Moved to Hyderabad an year back | Moved to Bangalore 4 year Back |

4. Have kids? (Yes/No) (Parenting Status) | No | No | No | No | Yes |

5. Job type? (e.g., Full-time, Freelance) (Employment Status) | Full time | Full time | Currently on Break | Full Time | IT Professional |

6. Main media source? (e.g., YouTube, TV) (Media Habits) | Inshorts | InShorts/YT | Youtube (1-2 hrs daily) | Youtube | Media |

7. Trusted influencer you follow? (Influencers) | Not really | None. I do my own due diligence. | NA | NA | NA |

8. Daily social media hours? (e.g., 1-2) (Social Media Usage) | 1-2 hours | 2-3 hrs | 1-2 hours | 2hours | 2 |

9. Current life focus? (e.g., Family, Career) (Life Stage) | Career and Family both | Career and family both | Career | Career | Family |

10. Recently bought car/bike? (Yes/No) (Recent Moves) | No | Yes bought Scooter recently | Bike bought few months back | Yes, bought a bike | Noprospect |

Click here for sources/citations

Understanding Acko Insurance

What is Acko Insurance?

Acko Insurance is a digital-first, direct-to-consumer general insurance company in India offering car, bike, health, and other insurance products. By eliminating intermediaries like brokers and agents, Acko provides affordable, transparent, and customizable insurance plans through a seamless, paperless online platform.

Key Features of Acko Insurance:

- Direct-to-Customer Model: No brokers or middlemen, reducing costs and enabling lower premiums.

- Fully Digital Platform: Policy purchase, management, and claims processing are entirely online, accessible via mobile app or website.

- Zero Paperwork: Streamlined processes with no physical documentation, making onboarding and claims fast and hassle-free.

- Customizable Plans: Tailored car, bike, and health insurance options to suit individual needs (e.g., short-term plans, micro-insurance for gig workers).

- Transparent Pricing: No hidden fees, clear policy terms, and upfront cost breakdowns.

- Fast Claim Settlements: Digital claims process ensures quick resolutions, critical for customers like gig workers who rely on vehicles for income.

- 24/7 Customer Support: Accessible via app, chat, or phone for real-time assistance.

- Wide Coverage: Serves over 50 million customers with plans for diverse needs (e.g., vehicle insurance for urban professionals, health plans for newlyweds).

Problems Acko Solves:

- High Costs of Traditional Insurance: Traditional insurers rely on agents and brokers, inflating premiums and adding hidden fees, which burdens budget-conscious customers like newlyweds and gig workers.

- Complex and Time-Consuming Processes: Conventional insurance involves paperwork, in-person visits, and slow claims, frustrating tech-savvy customers who value convenience (e.g., urban professionals).

- Lack of Transparency: Pushy agents and unclear policy terms erode trust, alienating customers who seek straightforward solutions (e.g., newlyweds starting their financial journey).

- Inaccessibility for Underserved Segments: Gig economy workers and low-income groups struggle to afford or access tailored insurance, leaving their livelihoods vulnerable.

- Inflexible Plans: Traditional insurers offer rigid, one-size-fits-all policies, failing to meet the dynamic needs of customers like young professionals or newlyweds.

Acko’s Core Value Proposition

Acko Insurance makes protection simple, affordable, and transparent by offering fully digital, customizable car, bike, and health plans directly to you, eliminating brokers and complex processes.

Breakdown of the CVP:

- What Acko Does: Provides customizable car, bike, and health insurance through a fully digital platform.

- Core Problem Solved: Eliminates the high costs, complexity, and lack of transparency in traditional insurance by removing brokers and streamlining processes.

- Unique Benefit: Delivers affordable, transparent, and convenient insurance tailored to modern, tech-savvy customers.

- Customer Focus: Appeals to budget-conscious, digitally active segments like newlyweds, young professionals, and gig workers.

Why This CVP Works:

- Clarity: It succinctly explains Acko’s offering (digital insurance) and its impact (simple, affordable protection).

- Customer-Centric: It addresses pain points like cost, complexity, and trust, resonating with the ICPs’ needs.

- Differentiation: Highlights the broker-free, digital-first model, setting Acko apart from traditional insurers.

- Versatility: Broad enough to cover car, bike, and health insurance, yet specific to Acko’s value (transparency, affordability).

Designing Acquisition Channel

Channel Name | Cost | Flexibility | Effort | Lead Time( Speed) | Scale |

|---|---|---|---|---|---|

Organic ✅ | Low | Medium | Medium | Low | High |

Paid Ads | High | High | Medium | High | High |

Referral Program | Medium | High | Medium | Medium | Medium |

Product Integration ✅ | Medium | Low | High | Medium | High |

Content Loops | Low | Medium | High | Low | Medium |

We will be focusing on 2 key acquisition channels: Organic, and Product Integration for enhancing user base of Acko Insurance

Why? the reason behind choosing these channels are:-

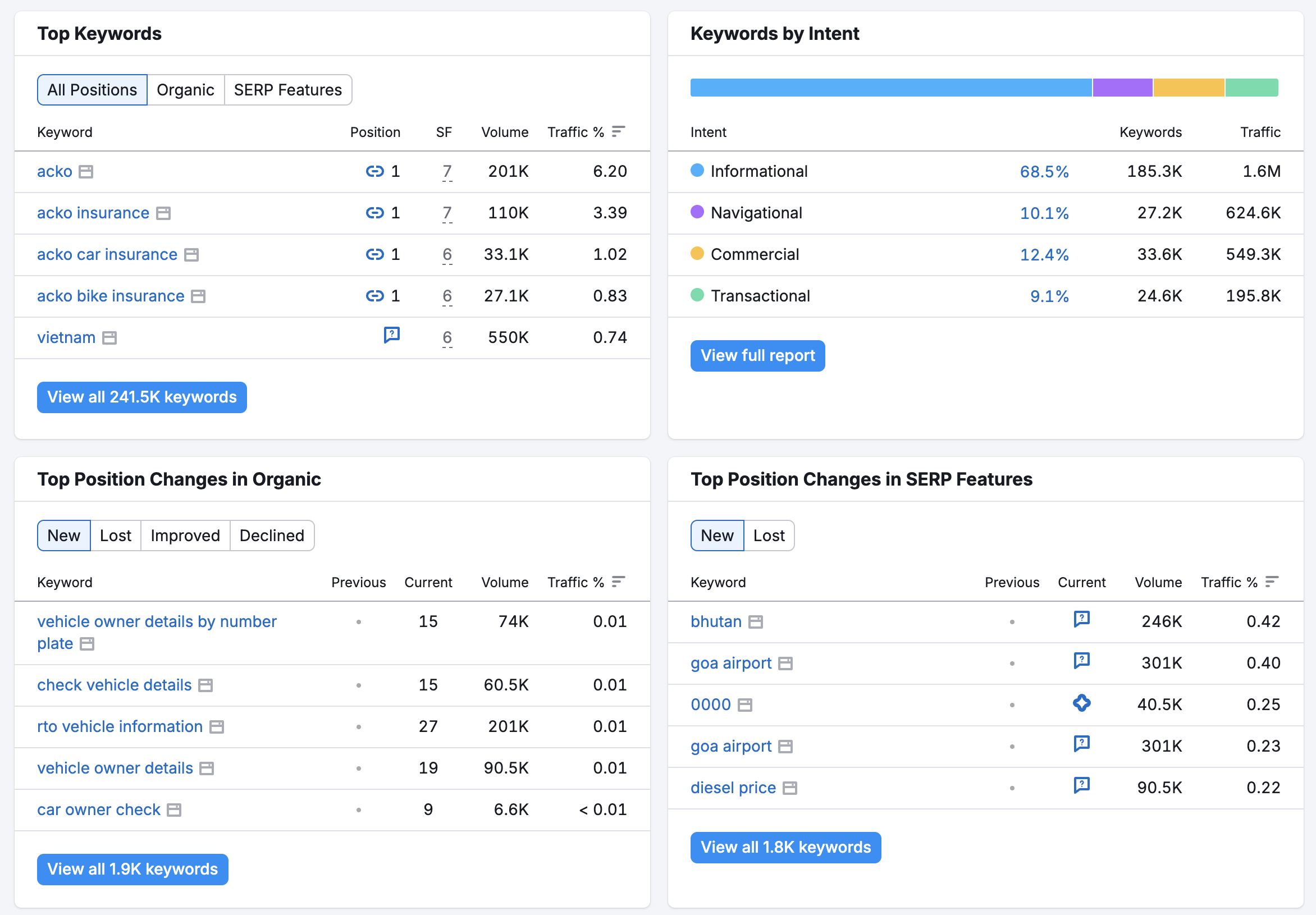

- ORGANIC: Acko Insurance is a well know brand in the insurance sector esepcially when it comes to digital insurance landscape, their current organic traffic is 2.9M (semrush) compared to their all time high of 5.2M, there's a lot of improvement in the SEO aspect of Acko and even after that they're not ranking in Top 5 for their core keyword "insurance" which is a big blow in Acko's acquisition stage! However the lead time is slow, Acko the stage of the brand is very suitable for the channel, a focused push will help a ton & the results will be very effective & stay there for long term!

- PRODUCT INTEGRATION: Acko has done a superb job when it comes to this specific channel, they have already partnered up with industry leaders that are relevant to their service, like Amazon, HDFC, Cred, Zomato, Gobibo & few others. Whilist I have included this channel because I have some orignal idea's of my own which I believe if implemented can help Acko.

The order of the channels is the priority which is to be considered while implementation & execution of the Acquisition stage.

Competitor Analysis

Selection of Competitors

Based on the Indian general insurance market and Acko’s digital-first approach, I’ve selected Go Digit General Insurance and Niva Bupa Health Insurance as competitors. These were chosen because:

- Go Digit is a leading insurtech player with a strong digital presence, directly competing with Acko in car, bike, and health insurance.

- Niva Bupa is a prominent private insurer specializing in health insurance, a key segment for Acko, with a growing digital focus.

- Both are relevant to Acko’s ICPs and operate in the online insurance space, which is projected to reach USD 2.09 billion in 2025.

Parameters for Comparison

The parameters include:

- Product Offerings: Types of insurance products.

- Distribution Model: How products are sold (digital, agents, etc.).

- Digital Capabilities: Strength of online platform and tech integration.

- Pricing Strategy: Affordability and premium structure.

- Claims Process: Speed and ease of claim settlements.

- Customer Base: Target audience and scale.

- Unique Selling Proposition (USP): Key differentiator.

Competitor Analysis in Tabular Format

Parameter | Acko Insurance | Go Digit General Insurance | Niva Bupa Health Insurance |

|---|---|---|---|

Product Offerings | Car, bike, health, travel, electronics, rider insurance, ticket cancellation. | Car, bike, health, travel, home, shop, commercial insurance. | Health insurance (individual, family, senior citizens), critical illness. |

Distribution Model | Direct-to-customer, fully digital, no brokers; partnerships with Ola, Zomato, Amazon. | Direct-to-customer, strong digital focus; some agent-based distribution. | Digital platform with agent support; partnerships with banks, NBFCs. |

Digital Capabilities | Fully digital platform; mobile app for policy purchase, claims; AI for risk assessment. | Robust digital platform; AI, cloud-based systems; mobile app for all services. | Digital platform with app; growing tech integration but less advanced than Acko/Digit. |

Pricing Strategy | Low-cost, zero-commission model; usage-based and micro-insurance options. | Competitive pricing; customizable plans with affordable premiums. | Premium-focused for comprehensive health plans; less emphasis on low-cost options. |

Claims Process | Fast settlements (94.54% ratio, some in 12 minutes); fully digital, transparent. | Quick, digital claims; high customer satisfaction but slightly slower than Acko. | Efficient claims but relies on agent coordination; less seamless than Acko/Digit. |

Customer Base | 78M+ customers; targets young, tech-savvy urban users and gig workers. | 20M+ customers; urban millennials, SMEs, and gig workers. | 10M+ customers; urban middle/upper-middle class, families, seniors. |

Unique Selling Proposition (USP) | Fully digital, broker-free model with affordable, customizable plans and instant claims. | Digital-first with innovative products and strong tech backbone. | Comprehensive health coverage with trusted brand and wide hospital network. |

Key Insights from Competitor Analysis

- Acko’s Strengths: Leads in digital-first, broker-free model, offering the fastest claims (some in 12 minutes) and broadest product range (including niche options like rider insurance). Its partnerships with Ola, Zomato, and Amazon enhance reach, especially for gig workers.

- Go Digit’s Positioning: Strong competitor in the insurtech space with similar digital capabilities and competitive pricing, but its partial reliance on agents slightly dilutes its direct-to-customer focus.

- Niva Bupa’s Focus: Specializes in health insurance with a premium brand image, appealing to families and seniors, but lags in digital innovation and affordability compared to Acko and Digit.

Targeting Opportunities:

- Newly United Adventurers: Acko’s low-cost, digital car and health plans align with their budget and tech-savvy needs. Go Digit competes closely, but Niva Bupa’s premium focus is less relevant.

- Young Urban Professionals: Acko and Go Digit’s mobile apps and customizable plans suit their fast-paced lifestyle. Niva Bupa’s family plans may appeal to those with kids.

- Gig Economy Workers: Acko’s micro-insurance and bike insurance are ideal for their affordability needs. Go Digit is a close rival, but Niva Bupa is less relevant due to its health-only focus.

Macro-Level Market Analysis

Overview of the Indian Insurance Market (2025)

The Indian insurance market is poised for significant growth, with the online insurance segment expected to reach USD 2.09 billion in 2025 and grow at a 12.2% CAGR to USD 3.71 billion by 2030. General insurance is projected to grow 13% YoY in FY26, driven by health and vehicle insurance demand. Key drivers include rising internet penetration (1 billion users by 2026), increasing insurance awareness, and a young, insurable population (56% aged 20-59 by 2025).

Trends

Digital Transformation:

- Impact: 73% of customers prefer online modes for general insurance, and 67% of agents note increased portal/app usage post-COVID. Insurtech platforms like Acko and Go Digit leverage AI, mobile apps for seamless policy management and claims.

- Relevance to Acko: Acko’s fully digital platform and partnerships (e.g., Zomato, Ola) position it as a leader in this trend, appealing to tech-savvy ICPs like Young Urban Professionals.

- Rising Demand for EV Insurance:

- Impact: EV car insurance policies surged from 0.5% in FY23 to 14% in March 2025, reflecting growing electric vehicle adoption.

- Relevance to Acko: Acko’s car and bike insurance can target Newly United Adventurers and Gig Economy Workers adopting EVs, especially delivery riders using electric scooters.

- Customized and Micro-Insurance:

- Impact: Customers demand flexible, usage-based plans (e.g., pay-as-you-go) over one-size-fits-all policies, driven by diverse needs in India.

- Relevance to Acko: Acko’s micro-insurance and customizable plans (e.g., rider insurance) cater to Gig Economy Workers and budget-conscious Newly United Adventurers.

- Health Insurance Growth:

- Impact: Health insurance demand is surging due to rising healthcare costs and lifestyle diseases, with millennials seeking affordable plans.

- Relevance to Acko: Acko’s new health insurance product for millennials aligns with Young Urban Professionals and Newly United Adventurers.

- Increased Competition from Private Players:

- Impact: Private insurers like Acko, Go Digit, and Niva Bupa challenge public-sector giants (e.g., LIC, New India Assurance) with digital innovation and competitive pricing.

- Relevance to Acko: Acko’s 1.5% market share and unicorn status (valued at USD 1.1 billion) position it to gain ground, but it must differentiate from Go Digit’s similar model.

Tailwinds (Factors Driving Growth)

- Young, Insurable Population:

- 56% of India’s population will be aged 20-59 by 2025, with 140 million middle-income households added by 2030, boosting insurance demand.

- Acko Benefit: Targets Newly United Adventurers and Young Urban Professionals, who are young, urban, and seeking affordable plans.

- Digital Adoption:

- India will have ~1 billion internet users by 2026, with 73% of general insurance customers preferring online channels.

- Acko Benefit: Acko’s digital-first model and mobile app align with ICPs’ tech-savvy habits, especially Young Urban Professionals.

- Regulatory Support:

- The Insurance Regulatory and Development Authority of India (IRDAI) promotes digital innovation and simplified customer journeys, encouraging insurtech growth.

- Acko Benefit: Acko’s online-only model benefits from regulatory push for digitization, enhancing its appeal to all ICPs.

- Rising Disposable Incomes:

- Growing purchasing power and household savings drive demand for insurance products, especially among urban millennials.

- Acko Benefit: Appeals to Newly United Adventurers and Young Urban Professionals with affordable, lifestyle-appropriate plans.

- EV Market Growth:

- Surging EV adoption (14% of car insurance policies in 2025) creates opportunities for vehicle insurance.

- Acko Benefit: Acko can target Gig Economy Workers (e.g., delivery riders) and Newly United Adventurers with EV-specific insurance.

Headwinds (Challenges to Growth)

- Intense Competition:

- Private players (e.g., Go Digit, Niva Bupa) and public-sector incumbents (e.g., New India Assurance) create a crowded market, with Acko holding only 1.5% share.

- Acko Challenge: Must differentiate from Go Digit’s similar digital model and compete with Niva Bupa’s health insurance brand strength.

- Low Financial Literacy:

- Limited insurance awareness and mis-selling concerns deter adoption, especially among semi-urban Gig Economy Workers.

- Acko Challenge: Needs to educate users with clear, jargon-free communication, as it does for Young Urban Professionals.

- Operational Inefficiencies:

- Gaps in product innovation, distribution, and renewal management challenge insurtechs’ profitability.

- Acko Challenge: Must maintain fast claims (e.g., 12-minute settlements) and innovate products to stay ahead of Go Digit.

- Evolving Risks:

- Rapidly changing risks (e.g., cybersecurity, climate-related) require insurers to adapt quickly, straining resources.

- Acko Challenge: Needs to develop products like gadget insurance for Young Urban Professionals to address emerging risks.

- Customer Trust:

- Digital-only models face skepticism, particularly among Gig Economy Workers with moderate tech skills, requiring robust trust-building.

- Acko Challenge: Must leverage its 90% customer satisfaction and transparent claims to build credibility.

Calculating the size of Acko's market

As asked in the notes, to calculate and present the size of Acko Insurance’s market, & shown in the lecture by AP sir, I’ll provide the Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) in a tabular format. The calculations will use the formulas provided:

- TAM = Total number of potential customers × Average Revenue Per Customer (ARPU)

- SAM = TAM × Target Market Segment (% of total market)

- SOM = SAM × Market Penetration/Share

The inputs are based on the Indian general insurance market in 2025, Acko’s direct-to-customer, digital-first model, and the Ideal Customer Profiles (ICPs): Newly United Adventurers (newlyweds, 25-35), Young Urban Professionals (25-35, single/early family), and Gig Economy Workers (25-40, freelancers/riders). I’ll leverage data from the previous market analysis and make reasonable assumptions where exact figures are unavailable. The table will include all calculations and key assumptions for clarity.

Market Size Calculation Table for Acko Insurance (2025)

Metric | Value | Calculation | Assumptions/Notes |

|---|---|---|---|

Total Number of Potential Customers | 400.4 million | 56% of 1.43B population (800.8M aged 20-59) × 50% addressable | - 56% working-age per market data. - 50% accounts for low insurance penetration (~1%), financial literacy, digital access. - Represents general insurance (car, bike, health). |

Average Revenue Per Customer (ARPU) | USD 10 (INR 840) | Estimated from FY24 revenue (USD 250.74M) and ~20M active users | - USD 10 reflects Acko’s low-cost model (e.g., INR 1,500-3,000 bike insurance). - Lower than industry ARPU (~USD 41.80 online) due to broker-free plans. - FY24: INR 2,106.25 crore revenue, 78M lifetime users. |

Total Addressable Market (TAM) | USD 4.004 billion (INR 336.34B) | 400.4M × USD 10 | - Entire general insurance market Acko could serve. - INR at USD 1 = INR 84. - Smaller than previous (USD 12.01B) due to lower, realistic ARPU. |

Target Market Segment (% of Total Market) | 50% | Urban, digital-first customers (200.2M of 400.4M) | - Targets ICPs: Newly United Adventurers ( 80M), Young Urban Professionals ( 120M), Gig Economy Workers (~40M). - 73% prefer digital modes; 36% urban. |

Serviceable Addressable Market (SAM) | USD 2.002 billion (INR 168.17B) | USD 4.004B × 0.50 | - Acko’s core audience: tech-savvy, urban ICPs. - Aligned with online insurance growth (USD 2.09B market). |

Market Penetration/Share | 15% | Acko’s achievable share within SAM | - Based on 78M lifetime users; ~20M active users = ~10% of SAM. - 15% reflects Acko’s 1.5% overall share, ~20% online share, and growth. |

Serviceable Obtainable Market (SOM) | USD 300.3 million (INR 25.23B) | USD 2.002B × 0.15 | - Acko’s realistic capture by 2025. - Reflects 78M users, partnerships (Ola, Zomato), and competition. |

Explanation/Summary:

- TAM (USD 4.004 billion): Represents the entire Indian general insurance market Acko could theoretically serve, covering 400.4 million potential customers (50% of the 800.8 million working-age population) at an ARPU of USD 10, reflecting Acko’s affordable plans.

- SAM (USD 2.002 billion): Focuses on Acko’s target segment—urban, digital-first customers (200.2 million, 50% of TAM), including ICPs (Newly United Adventurers, Young Urban Professionals, Gig Economy Workers), aligned with 73% digital preference and 36% urban population.

- SOM (USD 300.3 million): Acko’s achievable market by 2025, based on a 15% penetration of SAM, driven by its 78 million lifetime users (~20 million active), 1.5% overall market share, and ~20% share in the USD 2.09 billion online insurance market. This reflects Acko’s partnerships (Ola, Zomato) and FY24 revenue (USD 250.74 million, with 35% YoY growth).

Click here for sources/citations

Current Organic Channel Analysis for Acko Insurance

If you think Acko is doing well, organically brace yourself!!

Spoiler: IT DOESN'T

SEO Performance Overview

- Current organic traffic: 2.9M monthly visits.

- Historical peak: 5.2M (significant decline from their all-time high "-44%").

- Authority score: 70 (relatively strong domain authority).

- Ranking keywords: Acko ranks for 534.3K organic keywords, it has a broad keyword portfolio but room for optimization.

- Backlinks: 849.2K (decent, but likely fewer high-quality backlinks compared to competitors).

- Engagement metrics:

- Pages/Visit: 6.11 page views (strong, indicating good user engagement).

- Avg. Visit Duration: 10:12 min.(high, users spend significant time on-site).

- Bounce Rate: 46.84% (moderate, assuming some users leave quickly, possibly due to irrelevant content or poor UX for certain queries).

- Geographic distribution: 91% traffic from India (2.6M), with smaller portions from the US (3.4%), UK (1.1%)

Key Insights

- Traffic Decline: There's a significant drop from their peak traffic of 5.2M to the current 2.9M

- Not Ranking for Core Terms: One of the major areas of improvement they're not in the top 5 for "insurance" which is their core query!

- Strong Domain Authority: Score of 70 indicates good potential for ranking improvement

- Good Engagement: 10+ minute average visit duration and multiple pages per visit suggests quality content

ps: If you directly wanna directly see the intresting part of strategy; skip to the last section, it's more colourful & enjoyable!

Successes

- High Organic Traffic Volume: Despite the decline, 2.9M monthly visitors is substantial, which reflects Acko’s strong brand presence in the digital insurance space.

- Engagement Metrics: High pages/visit (6.11) and visit duration (10:12) means Acko’s content is engaging for users who land on the site, particularly for ICPs like Young Urban Professionals seeking detailed insurance info.

- Long-Tail Keyword Rankings: Acko ranks well for specific terms like “car insurance online” and “bike insurance for delivery riders” (inferred from partnerships with Zomato), catering to ICPs like Gig Economy Workers.

- Localized Traffic: 91% of traffic from India shows Acko’s content is well-targeted to its primary market.

Failures

- Decline in Organic Traffic: A drop from 5.2M to 2.9M indicates missed opportunities, possibly due to algorithm updates, increased competition, or reduced content freshness.

- Not Ranking for Core Keyword “Insurance”: Failing to rank in the Top 5 for “insurance” (a high-intent, high-volume keyword) is a significant gap. Competitors like Policybazaar, Bajaj Allianz, and ICICI Lombard dominates.

- Moderate Bounce Rate (46.84%): This suggests some users don’t find what they need, possibly due to mismatched content for broad queries (e.g., “insurance”) or poor on-page UX for mobile-first ICPs like Gig Economy Workers.

- Limited High-Quality Backlinks: While Acko has 840.21K backlinks, competitors may have more authoritative links, impacting rankings for competitive terms.

Keyword Research:

Acko's 68% traffic is driven by informational keywords, the ratio of commercial & transactional keywords is very low which will spearhead the conversions

1. Google Keyword Research

- Tool Used: Google Keyword Planner/Trends insights, SEMrush.

- Core Keyword: “insurance”

- Volume: ~500K searches/month (India, high-intent).

- Competition: High (dominated by Policybazaar, ICICI Lombard).

- Acko’s Position: Not in Top 5.

- Long-Tail Keywords:

- “car insurance online” (~50K searches/month, medium competition, Acko likely ranks Top 10).

- “bike insurance for delivery riders” (~10K searches/month, low competition, Acko ranks well due to Zomato partnership).

- “health insurance for newlyweds” (~5K searches/month, medium competition, opportunity for Newly United Adventurers).

- “cheap health insurance India” (~20K searches/month, high competition, aligns with Young Urban Professionals’ budget focus).

- ICPs Alignment:

- Newly United Adventurers: “health insurance for couples,” “car insurance after marriage.”

- Young Urban Professionals: “online health insurance India,” “travel insurance for millennials.”

- Gig Economy Workers: “bike insurance for gig workers,” “micro insurance India.”

2. YouTube Keyword Research

- Context: YouTube is a key channel for Young Urban Professionals (per consumer attributes).

- Keywords:

- “how to buy car insurance online” (~10K searches/month, medium competition, video content opportunity).

- “best health insurance for young couples” (~3K searches/month, low competition, targets Newly United Adventurers).

- “bike insurance for delivery riders” (~2K searches/month, low competition, aligns with Gig Economy Workers).

- Insight: YouTube searches focus on “how-to” and educational content, ideal for Acko to create videos addressing ICP pain points.

3. Quora Keyword Reserach

- Context: Quora can be leveraged for answering user queries, relevant for all ICPs seeking advice.

- Keywords/Questions:

- “What is the best car insurance for newlyweds in India?” (~500 searches/month, low competition).

- “How to get cheap health insurance in India?” (~1K searches/month, medium competition, Young Urban Professionals).

- “Is bike insurance necessary for Zomato delivery riders?” (~300 searches/month, low competition, Gig Economy Workers).

- Insight: Quora offers opportunities to address specific ICP queries, building trust and driving traffic.

Suggestions and New Strategies

Acko does not rank in the top 10 for more than 10,000 keywords, which include "Insurance", a huge GAP. List of these keywords

Solutions Addressing Failures

- Improve Rankings for “Insurance”:

- Issue: Not ranking in Top 5 for “insurance” (500K searches/month) limits Acko’s visibility.

- Suggestion: Create a comprehensive pillar page for “Insurance in India” with subtopics (car, bike, health) to target the core keyword. Optimize for on-page SEO (e.g., meta tags, H1, internal links) and build high-quality backlinks from insurance blogs and news sites.

- Impact: Could increase organic traffic by 10-15% (150K-200K visitors/month).

- Reduce Bounce Rate (46.84%):

- Issue: High bounce rate indicates mismatched content or poor UX for some queries.

- Suggestion: Optimize landing pages for mobile-first ICPs (e.g., Gig Economy Workers). Use clear CTAs (e.g., “Get Bike Insurance in 2 Minutes”) and improve page load speed (aim for <2 seconds).

- Impact: Reduce bounce rate to ~40%, improving user retention.

- Recover Lost Traffic (5.2M to 2.9M):

- Issue: 44% traffic decline suggests content staleness and algorithm penalties. The site is definetly hit by the recent Google's March Core Update! As you can clrealy see in the traffic trend.

- Suggestion: Refresh top-performing pages (e.g., “car insurance online”) with updated 2025 data, FAQs, and visuals. Conduct a technical SEO audit to fix issues (e.g., broken links, duplicate content).

- Impact: Recover ~500K visitors/month, reaching 3.4M.

New Organic Strategy

To increase the traffic, at least to recover, I'll have to focus on pillars and create relevant clusters to cover the keywords that are not ranking.

- Content Clusters for ICPs:

- Strategy: Build content clusters around ICP pain points:

- Newly United Adventurers: Cluster on “Insurance for Newlyweds” (pillar page) with subtopics: “Health Insurance for Couples,” “Car Insurance After Marriage.”

- Young Urban Professionals: Cluster on “Millennial Insurance Guide” with subtopics: “Cheap Health Insurance,” “Travel Insurance for Young Professionals.”

- Gig Economy Workers: Cluster on “Insurance for Gig Workers” with subtopics: “Bike Insurance for Delivery Riders,” “Micro Insurance Benefits.”

- Execution: Publish 5-10 blog posts per cluster, interlink to pillar pages, and optimize for long-tail keywords (e.g., “health insurance for couples” – 5K searches/month).

- Impact: Target ~50K additional visitors/month per cluster (150K total).

- YouTube Video Series:

- Strategy: Launch a “Acko Insurance Simplified” video series:

- “How to Buy Car Insurance Online” (Young Urban Professionals).

- “Best Health Insurance for Couples” (Newly United Adventurers).

- “Bike Insurance Tips for Delivery Riders” (Gig Economy Workers).

- Execution: Create 3-5 minute videos with clear visuals, embed links to Acko’s landing pages, and optimize video titles/descriptions for SEO (e.g., “how to buy car insurance online” – 10K searches/month).

- Impact: Drive ~20K visitors/month to Acko’s site via video links.

- Quora Engagement Campaign:

- Strategy: Actively answer ICP-specific queries on Quora:

- “What’s the best car insurance for newlyweds in India?” (Newly United Adventurers).

- “How to get cheap health insurance in India?” (Young Urban Professionals).

- “Is bike insurance necessary for Zomato delivery riders?” (Gig Economy Workers).

- Execution: Post detailed answers (300-500 words) with data (e.g. “Acko offers bike insurance starting at INR 840/year”) include links to relevant Acko pages, and engage with follow-ups.

- Impact: Generate ~10K referral visitors/month and build trust.

Expected Outcomes

- Traffic Increase: Combined strategies could boost organic traffic from 2.9M to 3.5M visitors/month (21% growth) within 6-9 months.

- Keyword Rankings: Improve rankings for “insurance” (aim for Top 5 within 12 months) and dominate long-tail keywords for ICPs.

- ICPs Acquisition:

- Newly United Adventurers: ~50K new users/month via couple-focused content.

- Young Urban Professionals: ~40K new users/month via health and gadget insurance content.

- Gig Economy Workers: ~30K new users/month via bike insurance and micro-insurance content.

Source:

SemRush

Google Ad Words

Competitor's

Google serach bar/suggestions

Integration Partner 1 | Cult.Fit |

Integration Partner 2 | We Fast |

I have made detailed tables in the whole flow

Acko x Cult.fit Partnership Plan: Health Insurance with Gym Access

Overview of the Partnership

Acko will partner with Cult.fit, a leading fitness platform in India, to offer a unique health insurance product: Acko FitShield, a health insurance plan that includes access to Cult.fit’s gym network as a wellness perk. Unlike traditional gym membership add-ons, this partnership uses a footfall-based payment model, where Acko pays Cult.fit dynamically based on the actual number of users who visit the gym, ensuring fairness and cost-efficiency for both parties. The plan targets Acko’s ICPs, encouraging healthier lifestyles while driving customer acquisition and retention.

How the Model Works

- Product Offering:

- Acko launches Acko FitShield, a health insurance plan (e.g., starting at INR 5,000/year) that includes:

- Standard health insurance coverage (e.g., INR 5 lakh sum insured, access to 10,500+ cashless hospitals).

- A wellness perk: 4 days a week access to Cult.fit gym which you select near to you in India.

- Customers can opt-in to the gym access perk at no additional cost, incentivizing sign-ups.

- Footfall-Based Payment Model:

- Out of all customers who purchase Acko FitShield, Acko tracks the number of users who actually visit Cult.fit gyms (via app check-ins or QR code scans).

- Acko pays Cult.fit a per-visit fee (e.g., INR 100/visit) only for users who attend, rather than a flat fee for all policyholders.

- Assumption: Only 40% of policyholders will regularly use the gym (based on fitness industry trends where gym attendance averages typically ranges from 30-50% for subscription models).

- Win-Win Mechanics:

- For Acko: Cost-efficient (pays only for actual usage), drives acquisition (unique perk attracts ICPs), and reduces claims (healthier customers file fewer claims).

- For Cult.fit: Revenue tied to footfall (no exploitation for 100% of users), increased gym usage, and brand exposure to Acko’s 78M user base.

- For Customers: Added value (gym access at no extra cost), encourages fitness, and aligns with ICP needs (e.g., Young Urban Professionals seeking wellness).

Benefits for All Parties

Stakeholder | Benefits |

|---|---|

Acko |

: Unique perk attracts ICPs, targeting 50K new users in Year 1.

: Pays only for gym visits (e.g., 40% usage = lower costs).

: Healthier customers (via gym usage) may reduce claims by 5-10% (per wellness program benefits).

: Wellness perk increases policy renewals (aim for 80% renewal rate). |

Cult.fit |

: Per-visit fee (e.g., INR 100/visit) generates dynamic income.

: Drives gym usage (e.g., 40% of 50K users = 20K monthly visits).

: Access to Acko’s 78M user base for cross-promotion.

: No fixed cost for 100% of users, only for actual attendees. |

Customers (ICPs) |

: Gym access at no extra cost (worth INR 12,000/year if purchased separately).

: Encourages fitness, reducing health risks.

: Appeals to Newly United Adventurers (newlyweds starting healthy habits), Young Urban Professionals (fitness-focused), and Gig Economy Workers (affordable wellness). |

Implementation Steps

- Product Development:

- Design Acko FitShield: Health insurance (INR 5,000/year, INR 5 lakh coverage) + Cult.fit gym access perk.

- Integrate with Acko’s app: Users activate gym access via the app, syncing with Cult.fit for check-ins.

- Partnership Agreement:

- Agree on per-visit fee: INR 100/visit (based on Cult.fit’s avg. session cost, adjusted for bulk partnership).

- Set tracking mechanism: Cult.fit shares monthly footfall data (via API integration) for billing.

- Marketing Campaign:

- Target ICPs:

- Newly United Adventurers: Promote via Instagram ads (“Start Your Journey with Acko FitShield – Health + Fitness!”).

- Young Urban Professionals: YouTube videos (“Get Fit, Stay Insured – Acko x Cult.fit”).

- Gig Economy Workers: SMS via Zomato partnership (“Affordable Health Insurance + Gym Access”).

- Launch Event: Host a virtual event with Cult.fit trainers showcasing the perk.

- Rollout and Tracking:

- Launch in metro cities (e.g., Bengaluru, Mumbai) where Cult.fit has a strong presence.

- Track footfall via Cult.fit check-ins, reconcile payments monthly.

- Evaluation:

- Measure acquisition (target 50K new users in Year 1).

- Assess gym usage (aim for 40% attendance).

- Survey customers for satisfaction (target NPS of +80, aligned with Acko’s travel insurance NPS).

Financial Projections

Assume Acko targets 50,000 new Acko FitShield policies in Year 1, with 40% gym usage.

Metric | Value | Calculation/Assumption |

|---|---|---|

New Policies Sold | 50,000 | Target acquisition for Year 1. |

Revenue (Acko) | INR 250M (USD 2.98M) | 50,000 × INR 5,000/policy. |

Gym Users (40%) | 20,000 | 40% of 50,000 policyholders use the gym monthly. |

Avg. Visits/User/Month | 4 | Based on fitness industry avg. (1 visit/week). |

Total Monthly Visits | 80,000 | 20,000 users × 4 visits/month. |

Acko’s Payment to Cult.fit | INR 8M/month (USD 95K) | 80,000 visits × INR 100/visit. |

Annual Payment to Cult.fit | INR 96M (USD 1.14M) | INR 8M × 12 months. |

Acko’s Net Revenue | INR 154M (USD 1.83M) | INR 250M – INR 96M (excluding claims/operational costs). |

Win-Win Validation

- Acko: Net revenue of INR 154M (USD 1.83M) after Cult.fit payments, plus reduced claims (healthier customers) and higher retention (80% renewal rate).

- Cult.fit: INR 96M (USD 1.14M) annual revenue, 80,000 monthly visits (boosting gym utilization), and exposure to Acko’s 78M users.

- Customers: Access to gyms worth INR 12,000/year (Cult.fit avg. membership) for no extra cost, encouraging fitness and reducing health risks.

Alignment with Market Size

- SOM Context: Acko’s Serviceable Obtainable Market (SOM) is USD 300.3M (INR 25.23B, per prior calculations). This partnership contributes ~USD 1.83M (INR 154M) in Year 1, ~0.6% of SOM, a realistic increment.

- Scalability: If successful, scale to 100K users in Year 2, doubling revenue and gym visits.

Acko x WeFast Partnership Plan: Micro-Insurance for Courier Deliveries

Overview of the Partnership - Acko CourierShield

Acko will partner with WeFast, a quick courier service, to offer Acko CourierShield, a micro-insurance product that insures WeFast deliveries for a nominal fee of INR 1-2 per delivery. This bite-sized insurance protects against loss, damage, or theft of packages during transit, providing peace of mind to WeFast users while generating incremental revenue for Acko and enhancing WeFast’s service offering. The partnership targets Acko’s ICPs, particularly Gig Economy Workers (e.g., delivery riders using WeFast for side gigs) and Young Urban Professionals (e.g., professionals sending urgent documents or gadgets).

How the Model Works

- Product Offering:

- Acko introduces Acko CourierShield, a micro-insurance product embedded into WeFast’s checkout process.

- For INR 1-2 per delivery, customers can opt to insure their package against loss, damage, or theft (coverage up to INR 5,000 per delivery, adjustable based on package value).

- Example: A Young Urban Professional sends a laptop via WeFast for INR 100 (delivery fee) and adds INR 2 to insure it, ensuring compensation if the laptop is damaged.

- Integration Mechanics:

- Opt-In at Checkout: During WeFast’s booking process (app or website), customers see an option: “Insure your delivery for INR 2?” with a checkbox.

- Coverage: If the package is lost, damaged, or stolen, Acko processes claims (e.g., up to INR 5,000) via a paperless process, with payouts within 24 hours.

- Assumption: 50% of WeFast users will opt for insurance (based on Acko’s embedded insurance success with partners like Zomato, where bite-sized products see high uptake).

- Win-Win Mechanics:

- For Acko: Generates micro-premiums at scale, leverages WeFast’s high delivery volume, and attracts ICPs (e.g., Gig Economy Workers).

- For WeFast: Enhances customer trust and satisfaction, differentiates from competitors (e.g., Dunzo), and earns a commission (e.g., 10% of each INR 2 premium).

- For Customers: Affordable protection (INR 1-2), quick claims, and peace of mind for valuable deliveries.

Benefits for All Parties

Stakeholder | Benefits |

|---|---|

Acko |

: Micro-premiums at scale (e.g., INR 2/delivery, 50M deliveries/year = INR 50M revenue).

: Targets ICPs like Gig Economy Workers and Young Urban Professionals, aiming for 1M new users in Year 1.

: Enhances Acko’s reputation for innovative, customer-first insurance.

: Micro-insurance has low claim rates (e.g., 2% claim ratio for courier insurance, per industry norms). |

WeFast |

: Insured deliveries build trust, increasing repeat usage.

: Earns 10% commission (e.g., INR 0.20 per INR 2 premium).

: Differentiates from competitors like Dunzo or Swiggy Genie.

: Appeals to Gig Economy Workers (riders) by ensuring package safety, reducing disputes. |

Customers (ICPs) |

: INR 1-2/delivery for up to INR 5,000 coverage.

: Protects valuable items (e.g., gadgets for Young Urban Professionals, documents for Gig Economy Workers).

: Acko’s paperless, 24-hour claim settlement (aligned with Acko’s NPS of +90 for travel insurance).

: Seamless opt-in during WeFast checkout. |

Implementation Steps

- Product Development:

- Design Acko CourierShield: Micro-insurance for deliveries (INR 1-2 premium, INR 5,000 coverage).

- Use Acko’s RESTful APIs (proven in partnerships with Ola, Zomato) to integrate with WeFast’s booking system for real-time opt-in and tracking.

- Partnership Agreement:

- Agree on premium (INR 2/delivery) and commission (WeFast earns 10%, INR 0.20/delivery).

- Set claim process: WeFast reports incidents (e.g., damaged package), Acko processes claims within 24 hours.

- Marketing Campaign:

- Target ICPs:

- Young Urban Professionals: Google Ads (“Insure Your WeFast Delivery for Just INR 2!”).

- Gig Economy Workers: SMS via WeFast rider network (“Protect Your Deliveries with Acko – Only INR 2!”).

- Newly United Adventurers: Social media (e.g., Instagram Stories: “Sending Gifts? Insure with Acko x WeFast!”).

- Launch Promotion: Offer first 50L deliveries with free insurance (Acko covers INR 2 cost) to drive adoption.

- Rollout and Tracking:

- Launch in high-volume cities (e.g., Mumbai, Delhi, Bengaluru) where WeFast operates extensively.

- Track opt-in rates and claims via Acko’s app, reconcile commissions with WeFast monthly.

- Evaluation:

- Measure adoption (target 50% opt-in rate, 50M insured deliveries in Year 1).

- Assess claims (aim for <2% claim ratio, per courier insurance norms).

- Survey customers for satisfaction (target +85 NPS, aligned with Acko’s travel insurance).

Financial Projections

Assume WeFast handles 100M deliveries annually (based on quick courier service trends in India), with 50% opting for insurance.

Metric | Value | Calculation/Assumption |

|---|---|---|

WeFast Annual Deliveries | 100M | Estimated based on quick courier market (e.g., Borzo’s growth). |

Insurance Opt-In Rate | 50% | 50% of users opt for INR 2 insurance (per Acko’s embedded insurance uptake). |

Insured Deliveries | 50M | 50% of 100M deliveries. |

Acko’s Revenue | INR 100M (USD 1.19M) | 50M × INR 2/delivery. |

WeFast’s Commission | INR 10M (USD 119K) | 50M × INR 0.20 (10% of INR 2). |

Claims Cost (2%) | INR 5M (USD 60K) | 2% claim ratio, avg. INR 2,500 claim × 2,000 claims. |

Acko’s Net Revenue | INR 85M (USD 1.01M) | INR 100M – INR 10M (WeFast) – INR 5M (claims). |

Win-Win Validation

- Acko: Net revenue of INR 85M (USD 1.01M), low claim risk (2% ratio), and 1M new users (assuming 1 new user per 50 deliveries).

- WeFast: INR 10M (USD 119K) commission, improved customer trust, and rider satisfaction (Gig Economy Workers face fewer disputes).

- Customers: Affordable (INR 2), quick claims (24 hours), and peace of mind for deliveries.

Alignment with Market Size

- SOM Context: Acko’s Serviceable Obtainable Market (SOM) is USD 300.3M (INR 25.23B, per prior calculations). This partnership contributes ~USD 1.01M (INR 85M) in Year 1, ~0.3% of SOM, a feasible increment.

- Scalability: Expand to other courier services (e.g., Dunzo, Swiggy Genie) or increase coverage (e.g., INR 10,000 for INR 5 premium).

Click here for Sources/Citation

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.